This is indeed not a late April fool’s day joke.

Artículo disponible en Español | Article disponible en Français

Last year, Apple released a monitor stand, asking 999$ for it, with the company’s fanbase rushing to defend the lump of aluminium as being some kind of revolutionary “high-tech” product. Others went a bit further with their defence, arguing that this product was aimed at the professional market, with these customers earning enough as to justify the cost.

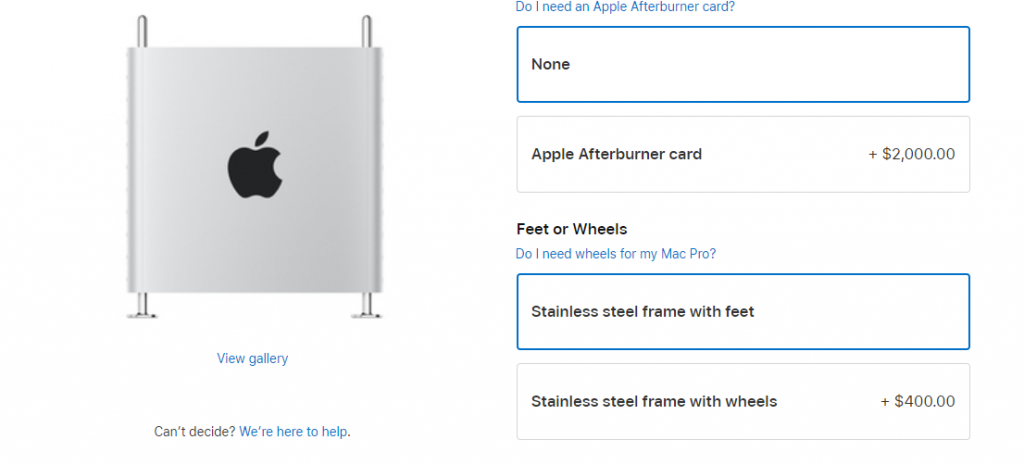

This year, the joke appears to repeat itself, with a kit of four wheels compatible with the Mac Pro, the “desktop” PC. Those purchasing the wheels option together with their Mac Pro will “only” have to pay 400$ for them, while those purchasing the wheels separately are looking at… 699$. For the four of them, yes. The company is not yet charging 699$ for each, but this being Apple, it wouldn’t be unsurprising if they did, especially at this point.

As per usual, some have come out to defend this product, getting, once again, very creative with the excuses. For instance, some have claimed that this product is aimed at companies looking for “tax optimisation”. While we cannot defend tax optimisation, and actually condemn it, this argument falls flat, at least in Europe. These people, who clearly lack any knowledge of accounting and how taxes work, claim the government will pocket their share in value-added-tax (VAT), with the higher price-tag thus resulting in higher taxes. According to their reasoning, the higher the price-tag, the more the government will make. The second part of their claims is that companies can then deduct the price-tag of these wheels from their revenue, thus paying lower taxes, but because they’ve already paid VAT on the purchase, these lower taxes don’t matter anymore.

While on paper this is true for regular consumers, this is not the case for business and professional expenses. When making a professional/business expense, and given that one has a VAT number (all companies will have one, while for self-employed professionals this will depend on whether they make enough money or not, although, in most cases, it is more advantageous to have one regardless, for reasons that will become obvious in a moment), one will indeed pay the VAT, but can then claim this one back, if the purchase is indeed intended for their business. To claim this one back, an invoice is required, invoice which includes the VAT number of the company or person making the purchase. In other words, not only can the company or professional claim back the VAT on these overpriced wheels, but they can also deduct them from their revenue, as a business expense. So not only are these companies not paying VAT, but they are lowering their overall profit and thus the taxes they’ll pay to the government. This could, indeed, be considered as “tax optimisation”. However, this remains a rather curious method to perform tax optimisation, as the goal is keeping as much of the profit as possible, while paying as little taxes as possible, which is not the end result in this case.

As it can be seen, it appears this is just Apple being Apple, checking how far they can push the envelope in terms of pricing before customers stop buying their products and start asking questions. The company can claim all they want that these wheels are “custom-designed” and made with “stainless steel and rubber wheels”, but the reality is that, not only are they not including all the tools required for the installation process, which, at 699$, is a joke in itself, but these wheels just look like what one can buy in bulk on Alibaba from China. If anything, the “custom-designed” part might be due to these wheels lacking a fundamental part to make them usable: a wheel brake. Here, unless the floor is perfectly flat, the PC will just roll away, forcing the user to place, or, ironically, buy, a set of wheel chocks. At the same time, it wouldn’t be surprising to see Apple releasing wheel chocks next year, asking a ludicrous amount of money for a piece of plastic or rubber.

If anything, it would be cheaper for employers to send one of their employees to a hardware store, get wheels from there in bulk and spend half a day to install them on their PCs, rather than buying Apple’s, with the end result being better too. And yes, hardware stores are able to provide company invoices, thus the VAT can be claimed back, making this option even cheaper.

More on this subject: