AMD’s shares have been gaining value at a fast pace over the past few months, but this may soon come to a halt.

Artículo disponible en Español | Article disponible en Français

Over the past few months, AMD shares have gone from being worth less than 15$ to being worth over 30$, as the company showcases new products and analysts increase the price target for the company’s shares.

This may be changing, as an analysts now downgraded AMD’s shares, unsure of whether the company can really top current expectations, as well as mentioning that Intel will eventually iron out its new process.

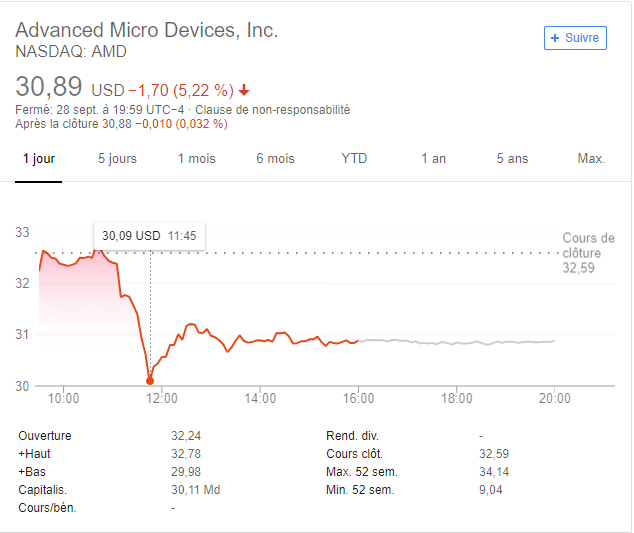

With Intel reporting they won’t have issues covering demand for their chips, as initially though, as well as mentioning progress is being made on their 10 nm process, AMD’s shares fell by 5%, from 32.24$ to 30.09$, although by now they are up to 30.89$ again. Meanwhile, Intel’s shares are up by 3% after the announcement.

Intel has been facing supply issues on the server market for a while now, due to manufacturing issues of their new chips. This comes with a high price-tag and security flaws that have yet to be resolved. AMD, on the other side, doesn’t face the same supply issues, its chips are not affected by most of the security flaws and come with lower prices for companies. The company is slowly gaining ground on the server market, thanks to its EPYC server CPUs. This trend is expected to continue.

More on this subject: