The US government has finally started granting licenses to some American companies to resume trading with Huawei.

Artículo disponible en Español | Article disponible en Français

A few weeks ago, it was rumoured that the US Department of Commerce would be granting licenses to US companies to resume trading with Huawei “soon”. While nothing changed for a few weeks, it appears things have started moving, with Microsoft being one of the first companies being granted a license to trade with Huawei once again. According to Microsoft’s statement, this license was issued on the 20th, and concerns “mass-market software”. It is unclear what “mass-market software” refers to, although we can safely assume Windows and Office are included in this category, being quite common software used “by the masses”. With this license, we can assume the Chinese manufacturer will soon be able to sell new MateBooks outside of China.

However, it remains unclear whether Huawei’s server business can fully resume, with the manufacturer having a series of server solutions running Microsoft’s software, as well as various solutions based around Microsoft’s Azure.

Still, even with this license, it is unclear whether Huawei will really be able to resume shipments of their MateBooks outside of China, for reasons beyond software. First, Microsoft’s license is good news… for Microsoft, as they will potentially be able to bury the new MateBooks running Linux out of the box, and thus avoid losing any market share at all. On the other hand, even if Huawei is able to resume shipments of Windows-based machines, it is unclear whether the company is in a potion to release or continue producing existing models.

What follows is some heavy speculation based on the current situation of the CPU market. Some might have noticed, but, in Europe for example, most MateBook models appear as sold out in most shops, with just a few models left in stock in some places. The models still available are mostly AMD-based solutions. At the same time, the MateBooks that were announced at the beginning of this year are still nowhere to be seen outside of China, which is curious. While we could blame it on the US ban, this one happened after Huawei announced their new laptops at the Mobile World Congress of this year, 2019, with these laptops unveiled at the end of February. The ban only took place in May, meaning Huawei had all the time needed to finish preparing the launch of these new models, as well as produce enough units to cover the launch demand.

Following the ban, various reports mentioned how Huawei had been secretly making preparations in case something like this happened, with part of these preparations being stockpiling US components worth billions, to such an extent that it is estimated this distorted the real demand for some tech components in 2018. The goal behind this massive stockpiling was to keep the company afloat for as long as possible, either long enough to weather out the storm or to find alternatives to most of the technology required for their products.

One of the key components needed to make a MateBook is, of course, the processor, or CPU. Currently, Huawei work(ed)s with two different suppliers, Intel and AMD, to power their machines, with Intel representing the bulk of what is sold, both due to their popularity and reputation amongst consumers. Some might have already understood our reasoning: Intel has been suffering from shortages of various parts, especially consumer-oriented parts, with the company focusing on the server market, due to this one being a much more lucrative market.

Thus, one can only stockpile what exists. If there is no supply of those specific parts, this means Huawei would be unable to buy them and keep them for later use, forcing them to rationalize the remaining resources by, for example, shifting their strategy and focusing on the main home market. Recent reports indicate that Intel’s shortage of consumer parts is expected to continue through this quarter, with Intel being very optimistic and claiming these shortages will be resolved by the beginning of 2020. This being the same company that has been claiming their 10nm is under way for years at this point, and still failing at it, many expect these shortages to continue lasting all the way until the second half of 2020, or even until 2021. Until then, we can all enjoy Intel’s glorious 14nm++ while the competition is already on 7nm with working products. Of course, these shortages are not without consequences, with brands such as HP, Lenovo or ASUS openly talking about their frustration about the situation, and with some analysts estimating that the consumer market could have grown by 7 or 8% instead of the 4% it did.

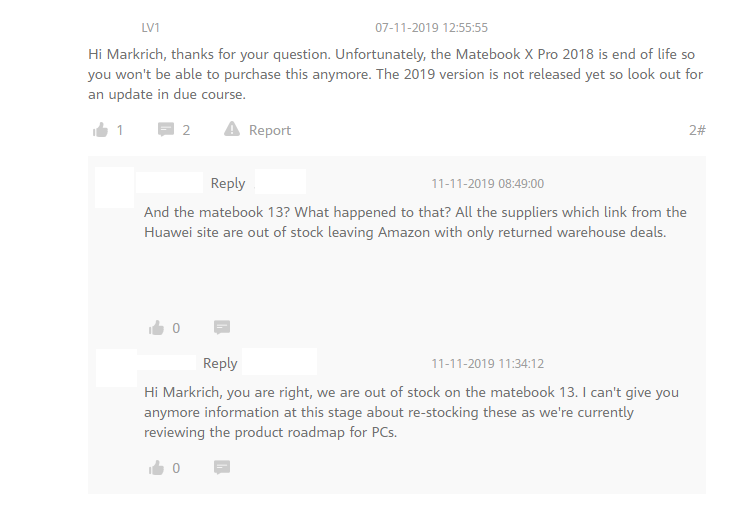

While we might be entirely wrong and some parts might sound like a stretch, the supply problems with Intel are real, and the out of stock machines all over Europe prove something is going on at Huawei, as the initial ban on Microsoft should not have affected existing machines, in a similar way to what happened with Google services on existing devices. To support our arguments of Huawei having little to no stock left of Intel CPUs, we have two comments left by a representative of Huawei UK, confirming that the MateBook X Pro 2018 is “end of life” and thus is not produced anymore. The representative also mentions the company is currently “reviewing the product roadmap for PCs”, which, coupled with the rest of this information can be linked to, again, a shortage of processors. We’ve anonymized the comments, but they can be easily found on Huawei’s UK Community:

The comment about “reviewing the product roadmap for PCs” is also quite curious, especially since it can only really be understood in one way: the company is selecting which models to produce and distribute and which models to shelve, likely to balance consumer demand and revenue, such as, for example, keeping Intel CPUs for high-end MateBooks and producing lower-end models such as the MateBook D with AMD CPUs only.

The 2019 MateBook X Pro not being out is also rather ironic, with the year already essentially being finished. There’s also still no word on whether Intel, nVidia or AMD are part of the companies that have received or will receive an exemption from the US Department of Commerce and thus resume trade with the Chinese manufacturer, although some of them have already been supplying some parts that were not covered by the ban.

More on this subject: